colorado tax attorney Free colorado tax power of attorney form – dr 0145

A tax power of attorney form is a legal document that authorizes an individual or entity to represent another person in matters related to taxes. In the state of Colorado, there are specific forms that must be used to designate someone as a tax power of attorney. This article will provide an overview of the Colorado tax power of attorney form and its importance.

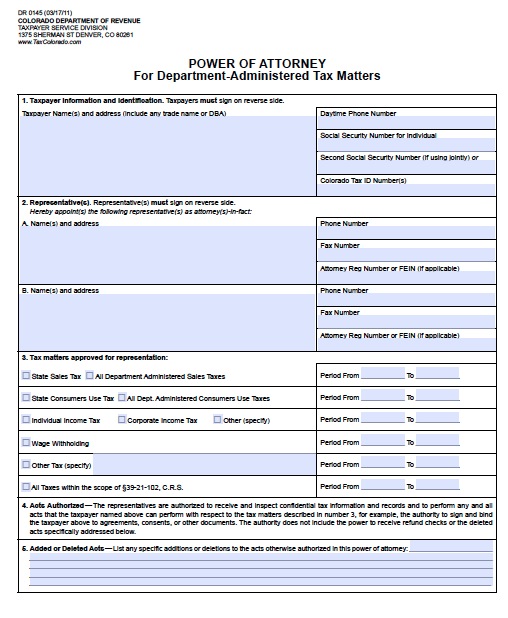

Free Colorado Tax Power of Attorney Form – DR 0145

The Free Colorado Tax Power of Attorney Form – DR 0145 is a comprehensive document that allows an individual to grant powers to another person to act on their behalf for tax-related matters. This form is available for free and can be easily accessed and downloaded from the official Colorado Department of Revenue website.

The form consists of several sections that must be filled out accurately to ensure the proper authorization is granted. These sections include the taxpayer information, representative information, and the specific powers being granted to the representative. It is essential to provide all the necessary details to avoid any confusion or delays in the representation.

Colorado Tax Power of Attorney Form

The Colorado Tax Power of Attorney Form is another official document that allows individuals to designate someone as their tax power of attorney. This form recognizes the authority of the representative to act on behalf of the taxpayer in tax-related matters, including signing tax returns, providing and receiving information, and discussing tax matters with the Colorado Department of Revenue.

Similar to the DR 0145 form, the Colorado Tax Power of Attorney Form requires detailed information about both the taxpayer and the representative. It is important to provide accurate and up-to-date information to ensure that the representative has the necessary authority to fulfill their duties.

Having a tax power of attorney is crucial, especially for individuals who may have difficulty managing their tax affairs due to physical or mental limitations. By designating a trusted representative, taxpayers can ensure that their tax matters are handled professionally and in compliance with relevant regulations.

When completing a tax power of attorney form, it is essential to carefully read the instructions and fill out all the required fields accurately. If any information is missing or incorrect, it could lead to delays or complications in the representation process.

In conclusion, the Colorado tax power of attorney form is a critical legal document that allows individuals to delegate their tax responsibilities to a representative. By granting someone the authority to act on their behalf, taxpayers can have peace of mind knowing that their tax matters are being handled by a trusted individual. It is advisable to consult with a legal professional or tax specialist for guidance in completing the form and ensuring compliance with all applicable laws and requirements.

Post a Comment for "colorado tax attorney Free colorado tax power of attorney form – dr 0145"